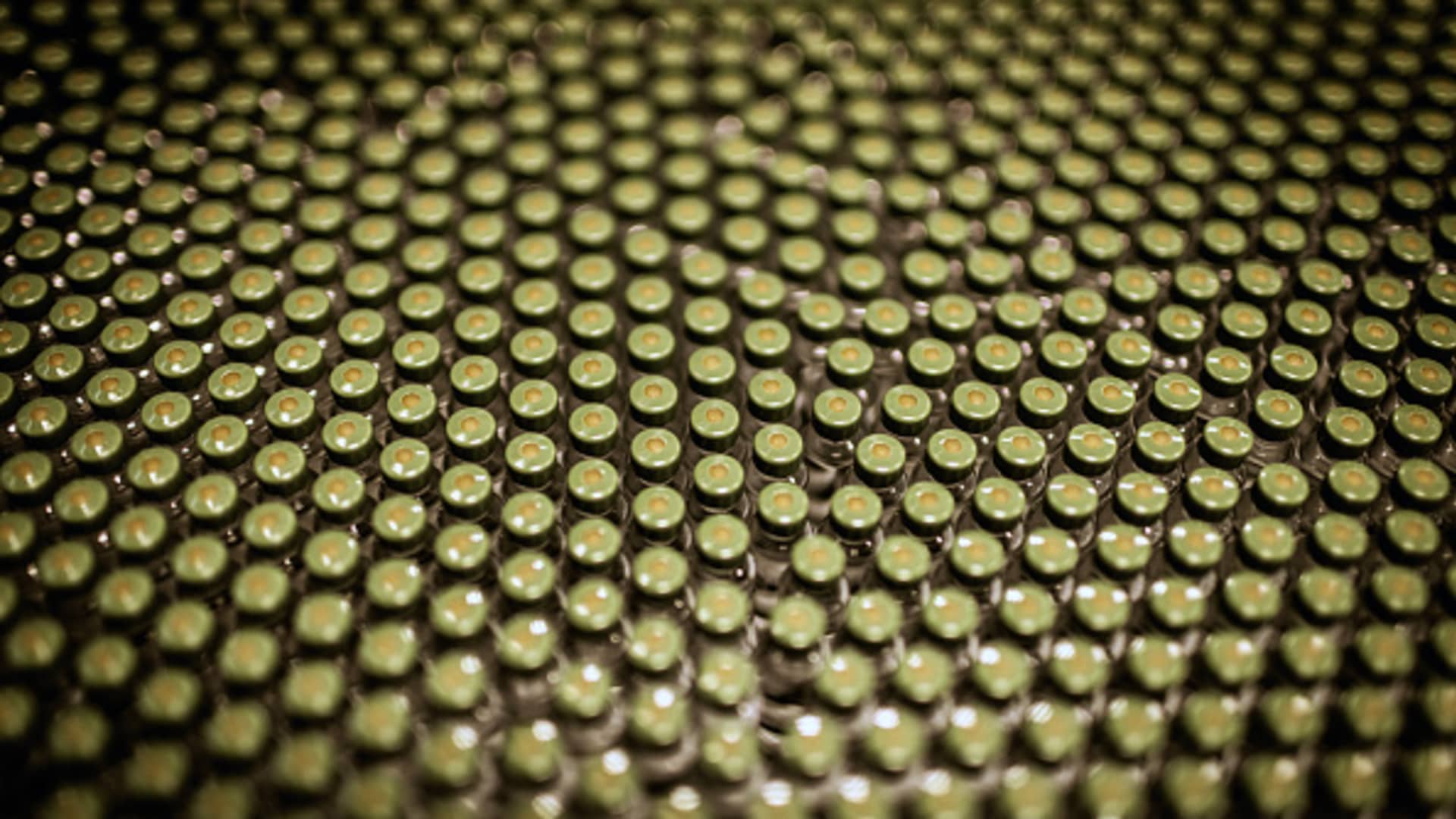

Vials transfer alongside a conveyor on the Novo Nordisk A/S manufacturing amenities in Hillerod, Denmark, on Monday, June 12, 2023. The success of Novo’s bestsellers Ozempic and Wegovy, medication that assist folks lose important quantities of weight, has created one thing of a gold rush within the pharma business with about 40 firms growing merchandise that may intensify competitors.

Bloomberg | Bloomberg | Getty Photos

Denmark’s financial development, which economists say is because of an “distinctive surge” in pharmaceutical exports, is predicted to weaken this 12 months — however the looming risk of U.S. tariffs on the pharma business will not be a lot of a contributing issue, in line with the Worldwide Financial Fund.

The IMF on Tuesday mentioned in its newest report on the Nordic nation that it expects Denmark, whose economic system grew 3.7% in 2024, to see its output average to 2.9% this 12 months and to 1.8% in 2026. The declines are set to happen amid anticipated weak spot in export development, together with that of pharmaceutical items.

The fund however famous that Denmark will likely be protected against potential U.S. tariffs on pharmaceutical imports, as most Danish drug merchandise are neither produced within the nation, nor cross its borders.

Danish drugmakers have turn into more and more reliant on a “merchanting and processing” system during which a lot of the worth of the medicines is attributable to the mental property embedded in them, with medication firms contracting producers in different nations to provide and ship the merchandise.

“The U.S. is a key buying and selling accomplice; nevertheless, exports produced in Denmark passing by customs account for less than 3 p.c of complete exports, limiting the direct influence of U.S. tariffs on the Danish economic system,” the IMF mentioned, including that “direct impacts from U.S. tariffs are anticipated to be restricted, however heightened commerce tensions and commerce coverage uncertainty pose dangers to the outlook.”

Past 2026, the fund mentioned, medium-term development is projected at round 1.5%, “reflecting a maturing pharmaceutical sector and a declining working-age inhabitants.”

Final fall, IMF economists remarked that Denmark’s development had been pushed by an “distinctive surge” in its pharma business whereas the remainder of the economic system had remained “comparatively subdued.”

The fund singled out Danish pharmaceutical large Novo Nordisk‘s large enhance in overseas demand for its diabetes and weight reduction drugs, Wegovy and Ozempic, as a driver of development, noting that the corporate’s gross sales as a share of Denmark’s GDP elevated from 1% within the early Nineteen Nineties to eight.3% in 2023.

Looming risk posed by Trump

A much bigger headwind for the broader European pharmaceutical business is U.S. President Donald Trump’s risk to impose tariffs on drug imports.

Prescribed drugs have been exempted from Trump’s preliminary “reciprocal” tariffs regime introduced in April, however the president has since set his sights on the worldwide business, threatening to put separate levies on prescription drugs exported to the States and demanding that U.S. drug costs come down.

Signaling his intent on the matter, Trump on Monday signed an govt order directing drugmakers to decrease their drug costs to align with the considerably decrease costs which can be paid overseas.

The president didn’t confer with particular nations, however signaled that he would goal different developed nations as a result of “there are some nations that want some further assist, and that is nice.”

“Mainly, what we’re doing is equalizing,” Trump mentioned throughout a press occasion on Monday. “We’re going to pay the bottom worth there’s on the earth. We’ll get whoever is paying the bottom worth, that is the value that we will get.”

White Home officers didn’t disclose which drugs the order will apply to, however mentioned that it’ll influence the industrial market in addition to Medicare and Medicaid.

In 2022, U.S. costs throughout all medication (manufacturers and generics) have been almost thrice as excessive as costs in 33 OECD comparability nations, in line with knowledge launched in 2024 by the U.S. Division of Well being & Human Providers.

U.S. President Donald Trump gestures on the day he indicators an govt order on prescription drug pricing throughout a press convention within the Roosevelt Room on the White Home in Washington, D.C., U.S., Might 12, 2025. REUTERS/Nathan Howard

Nathan Howard | Reuters

The specter of tariffs on pharmaceutical imports has been described as a “sword of Damocles” hanging over Europe’s pharma business, with CEOs warning that there might be an exodus of main continental gamers to the U.S. in a bid to keep away from levies.

The European Federation of Pharmaceutical Industries and Associations (EFPIA), which represents main European pharmaceutical firms — together with Novo Nordisk, Bayer, AstraZeneca, GSK, Roche and Sanofi — warned European Fee President Ursula von der Leyen in April that “except Europe delivers fast, radical coverage change then pharmaceutical analysis, improvement and manufacturing is more and more more likely to be directed in the direction of the U.S.”

It mentioned {that a} survey of its members confirmed that round 100 billion euros ($112 billion) value of capital expenditure and analysis and improvement investments have been in danger consequently.

“The U.S. now leads Europe on each investor metric from availability of capital, mental property, pace of approval to rewards for innovation. Along with the uncertainty created by the specter of tariffs, there’s little incentive to spend money on the EU and important drivers to relocate to the U.S.,” the EFPIA mentioned.

— CNBC’s Annika Kim Constantino and Karen Gilchrist contributed reporting to this story