By Summer time Zhen

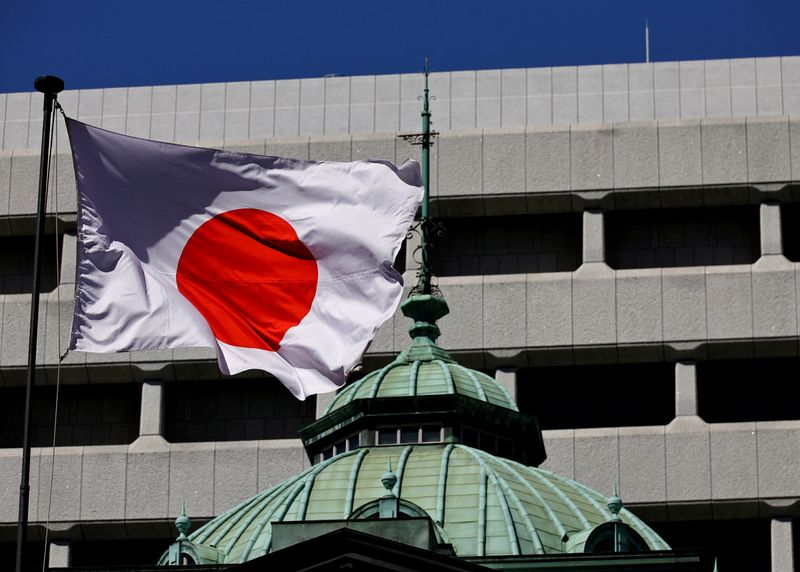

HONG KONG (Reuters) – Japanese banks have attracted bigger international funding flows than different sectors, as buyers see them as high beneficiaries of potential financial tightening.

Analysts stated Japan’s emergence from many years of deflation and better charges will imply higher earnings for banks, supporting their inventory costs.

WHY IT’S IMPORTANT

The Financial institution of Japan ends a two-day coverage assembly on Wednesday and will elevate rates of interest and taper its purchases of bonds, following its ending of unfavourable rates of interest in March.

Because it prepares to unwind a decade of financial stimulus, buyers who’ve witnessed the inventory index rally 20% prior to now 12 months are attempting to choose winners.

BY THE NUMBERS

Banks and cars are two sectors with web international funding inflows to this point this 12 months.

Banks lured an estimated 472 billion yen ($3.1 billion) of web inventory purchases within the 12 months to July 25, greater than double the flows into the cars and parts sector, in response to J.P. Morgan quantitative technique staff.

CONTEXT

Japan’s three largest banks forecast document earnings within the coming 12 months, thanks to raised curiosity margins and rising funding demand, after being squeezed by unfavourable charges for years.

Shares of Sumitomo Mitsui (NYSE:) Monetary Group, Mitsubishi UFJ (NYSE:) Monetary Group and Mizuho Monetary Group have surged 53%, 39% and 36% year-to-date, respectively.

Abroad buyers have additionally been shopping for extra domestic-oriented sectors similar to companies and prescription drugs, on expectations of additional features within the yen.

KEY QUOTES

Yue Bamba, Blackrock (NYSE:)’s head of energetic investments for Japan: “We’re going from very troublesome instances to rather more conducive atmosphere for all of the banks. We predict their outperformance can proceed… even incremental will increase in rates of interest lead to direct advantages from an ROE perspective.”

Zuhair Khan, senior portfolio supervisor at UBP: “Mega-banks might be beneficiaries of rising charges as they’ve extra lending alternatives than regional banks, nevertheless I consider this profit is already greater than priced into the shares.”

($1 = 153.7200 yen)