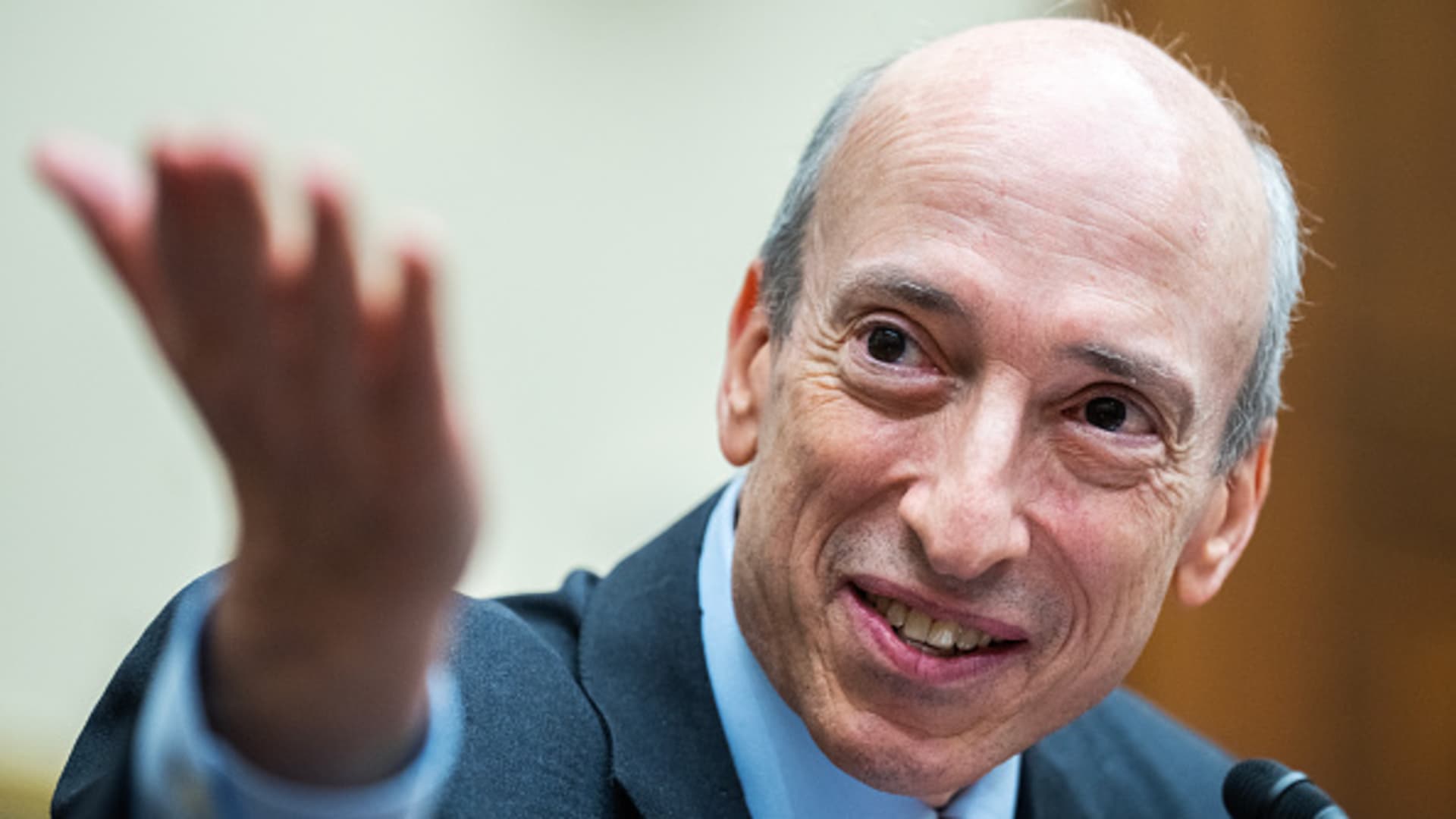

Company America now has a giant likelihood to roll again rules. Securities and Change Fee Chairman Gary Gensler has sought to dramatically enhance regulation of company America, vastly growing disclosure necessities specifically. In response, company America has introduced an avalanche of lawsuits in opposition to Gensler and the SEC. With a brand new regime now coming into the SEC following Donald Trump’s victory within the presidential race, how will they reply to the lawsuits? What’s going to the brand new management on the SEC seem like? CNBC spoke with Larry Tabb, director of market construction analysis at Bloomberg Intelligence. The questions have been edited for brevity and readability. With the election over, what’s going to occur to the management of the SEC? Gary Gensler’s chairmanship doesn’t expire till 2026, however it’s seemingly he’ll step down as chairman. Nevertheless, Gensler additionally stays as a commissioner. There may be presently three Democrats and two Republicans, however that may seemingly flip below the Trump administration. Might Gensler keep on as a commissioner? It will be odd, however he may do it. However he would turn out to be an everyday commissioner, and never solely lose management of the company’s agenda however the majority of its individuals. He would have one vote and some advisors. Are there are any favorites for SEC chairman? Dan Gallagher, now serving as Robinhood’s chief authorized officer and previously a Republican SEC commissioner, has been floated as a potential substitute. One other risk is among the present Republican SEC commissioners, Hester Peirce, who has opposed many of the new rulemakings and lawsuits that Gensler has initiated. Nevertheless, Peirce is an instructional who has proven little political ambition and it is unclear if she would even need the job. The opposite Republican commissioner is Mark Uyeda who has been on the SEC some time, and he could also be a alternative for both appearing chair or chairman. What occurs to Gary Gensler’s present agenda? There are dozens of pending guidelines which have but to be adopted. The incoming chairman controls the workers and the agenda. Gensler’s agenda can be placed on maintain. Gensler nonetheless has a majority on the SEC. Is it potential he’ll attempt to push by means of further guidelines earlier than he leaves? It is potential, however even right here there are limits to what he may be capable of do. The Congressional Evaluation Act permits Congress to overturn rules handed within the final portion of a earlier administration. What may be the priorities for the incoming SEC chair? That can rely very a lot on the incoming chairman. There’s little doubt a Republican-led SEC can be extra sympathetic to crypto. Gensler has stated he believes most crypto currencies are securities. I believe there can be an try and extra clearly outline which crypto currencies are or will not be securities, which might go a good distance towards clearing up regulatory uncertainty. There’ll seemingly be a much bigger push for broad laws in Congress that might give a lot of the facility to control crypto to the CFTC. There might also be an effort to reinvigorate the IPO market. Serving to firms turn out to be public could possibly be a precedence, together with an effort to remove present guidelines which impede capital formation and make investing costlier. What about all of the rules that the SEC handed below Gensler? Might the brand new administration undo these rules? They might, however there’s a lengthy course of that must be adopted. Primarily, it’s the rule-making course of in reverse. They would want to suggest to undo the rule, submit a discover and remark interval, after which vote. The SEC is being sued over dozens of rules Gensler has enacted, together with board range, share buybacks, short-sale disclosures, securities mortgage reporting, registration of Treasury market sellers, local weather disclosure, and cybersecurity. A lot of them allege that the SEC has overstepped its regulatory authority. What’s going to occur to those lawsuits? The SEC is an unbiased company however they’ve nice latitude in deciding how to answer lawsuits. Most of those fits are nonetheless pending in federal courtroom. As quickly as a brand new Republican chairman is available in, I think many of those lawsuits will in all probability not be contested and the rules is not going to go into impact. How would that work? In a lawsuit, an organization is suing the SEC, claiming, for instance, that they don’t have statutory authority to require extra disclosure of some a part of their enterprise. The SEC has to answer the lawsuit. One factor the SEC may do is solely resolve to not contest the allegations. The courtroom would then say, in impact, ‘Oh so that you agree with the swimsuit, you over-reached,’ and the courtroom is not going to permit the regulation to enter impact. Alternatively, they may inform the courtroom they agree that the rule would not comply after which say they may go and repair it, however in impact do nothing. I’m not positive the SEC would wish to publicly again away from guidelines they proposed and voted on. Any guidelines specifically the incoming administration may be wanting to rescind? Local weather change, securities finance/ lending, and I’m positive there are others. Are there every other causes to imagine rulemaking can be drastically curtailed below the Trump administration? Sure. The Chevron doctrine was established by the Supreme Courtroom in 1984, it granted deference to a authorities company’s interpretation of guidelines, offering they had been affordable. This was overturned this yr by the Supreme Courtroom, which held that the Administrative Process Act required courts to train unbiased judgement in deciding whether or not an company acted inside its statutory authority. What’s the impact of that ruling? It is nonetheless being labored out, however it would seemingly scale back the facility of federal companies to make guidelines and enhance the position of courts in deciphering these guidelines. That stated, the SEC has not traditionally relied on Chevron, so this ruling will in all probability have little impression, however suing the SEC has turn out to be very talked-about, not solely by dealer, companies and exchanges but additionally by the buyside, which is absolutely aggressive for cash managers (or their associations). There may be little technique to put this genie again within the bottle with out altering technique, so you’ll proceed to see many lawsuits, which has and can undermine the authority of the company. The one means out of that is two-fold: one, take out a giant stick and use enforcement to push again on the trade and/or two, return to the trade and search consensus. The trade is after all searching for quantity two, however it might be a mix of each.