A buyer locations a Japanese 10,000 yen banknote on a checkout counter whereas making a purchase order at an Akidai YK grocery store in Tokyo, Japan, on Monday, June 27, 2022.

Kiyoshi Ota | Bloomberg | Getty Pictures

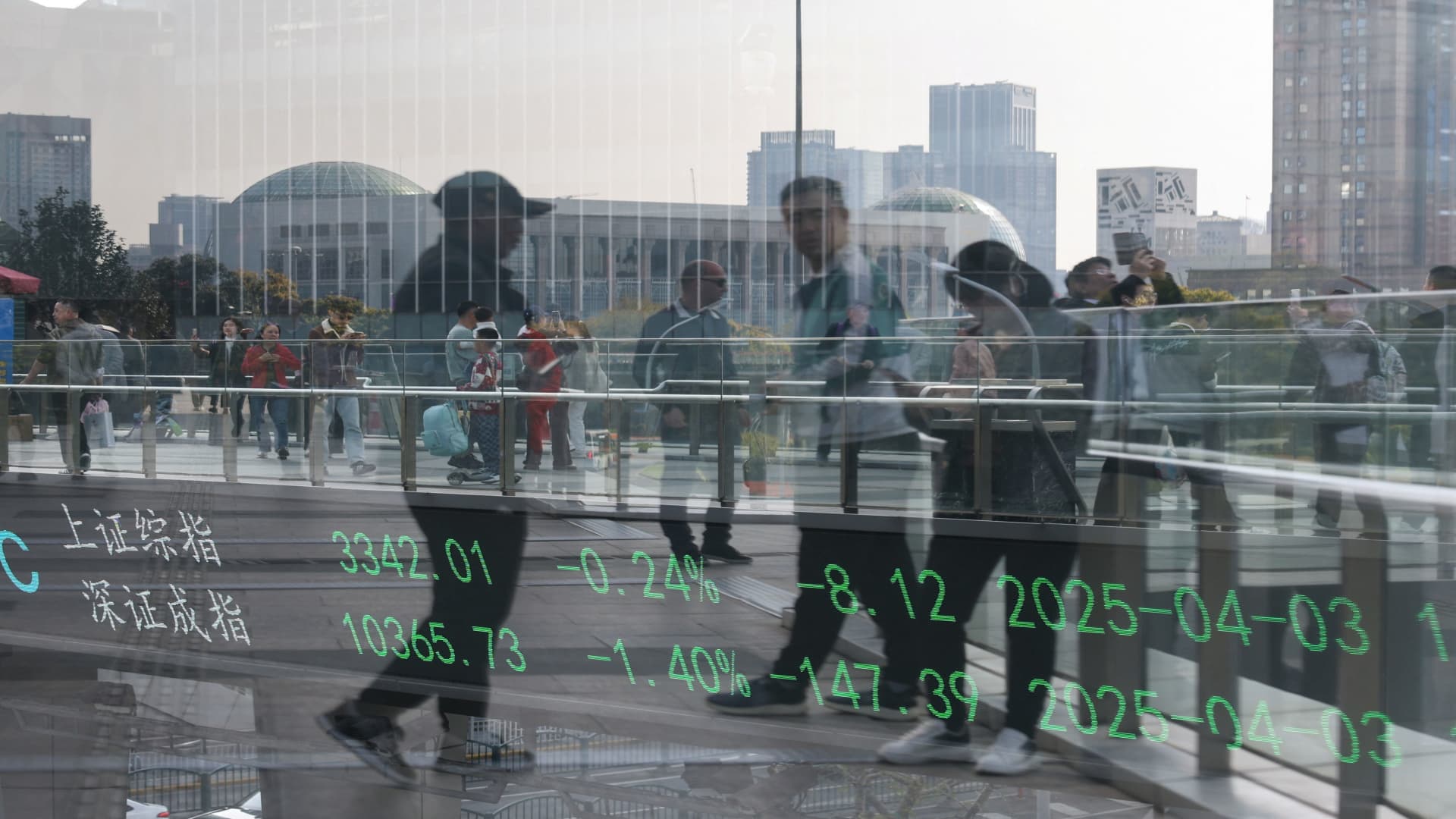

SINGAPORE — Asia-Pacific markets principally fell on Tuesday, with buyers watching August pay and spending information out from Japan and as mainland Chinese language markets return to commerce.

Family spending in Japan fell 1.9% year-on-year in August in actual phrases, a softer fall in comparison with the two.6% decline anticipated by a Reuters ballot of economists.

The drop is the quickest tempo of decline since January, which noticed a 6.3% fall year-on-year. That decline additionally got here earlier than spring wage negotiations delivered the biggest pay hikes to unionized Japanese employees in 33 years.

Nonetheless, actual wages rose in August, with information from the nation’s statistics bureau indicating that wages climbed 2% to a mean of 574,334 yen ($3,877.44).

The benchmark Nikkei 225 slipped 0.75% after the discharge, whereas the Topix was down 0.88%.

South Korea’s Kospi was 0.61% decrease, dragged by shares of heavyweight Samsung Electronics after it launched worse than anticipated third quarter steerage.

The small cap Kosdaq was down 0.14%.

Futures for Hong Kong’s Dangle Seng index stood at 23,169, pointing to a stronger open in comparison with the HSI’s shut of 23,099.78. Monday’s shut was the primary time the HSI had retaken the 23,000 mark since February 2022.

Australia’s S&P/ASX 200 began the day up 0.16%.

In a single day within the U.S., shares slid as rising oil costs and better Treasury yields weighed on market sentiment.

The Dow Jones Industrial Common dropped 0.94%, whereas the S&P 500 slid 0.96%. The Nasdaq Composite noticed the biggest loss, falling 1.18%.

The benchmark 10-year Treasury yield rose to 4.02%, marking the primary time since August that the yield topped 4%.

Oil costs additionally rose as tensions within the Center East stay excessive. U.S. crude climbed greater than 3% to settle above $77 per barrel.

— CNBC’s Lisa Kailai Han and Jesse Pound contributed to this report.