Merchants work on the ground of the New York Inventory Alternate throughout morning buying and selling on November 26, 2024 in New York Metropolis.

Michael M. Santiago | Getty Photos

The S&P 500 rose to new heights on Friday amid a shortened buying and selling day that may cap a robust month for equities.

The broad S&P 500 added 0.7% and hit a recent intraday excessive, whereas the Nasdaq Composite rose 0.9%.The Dow Jones Industrial Common climbed 347 factors, or 0.7%, on observe for its first-ever shut above 45,000.

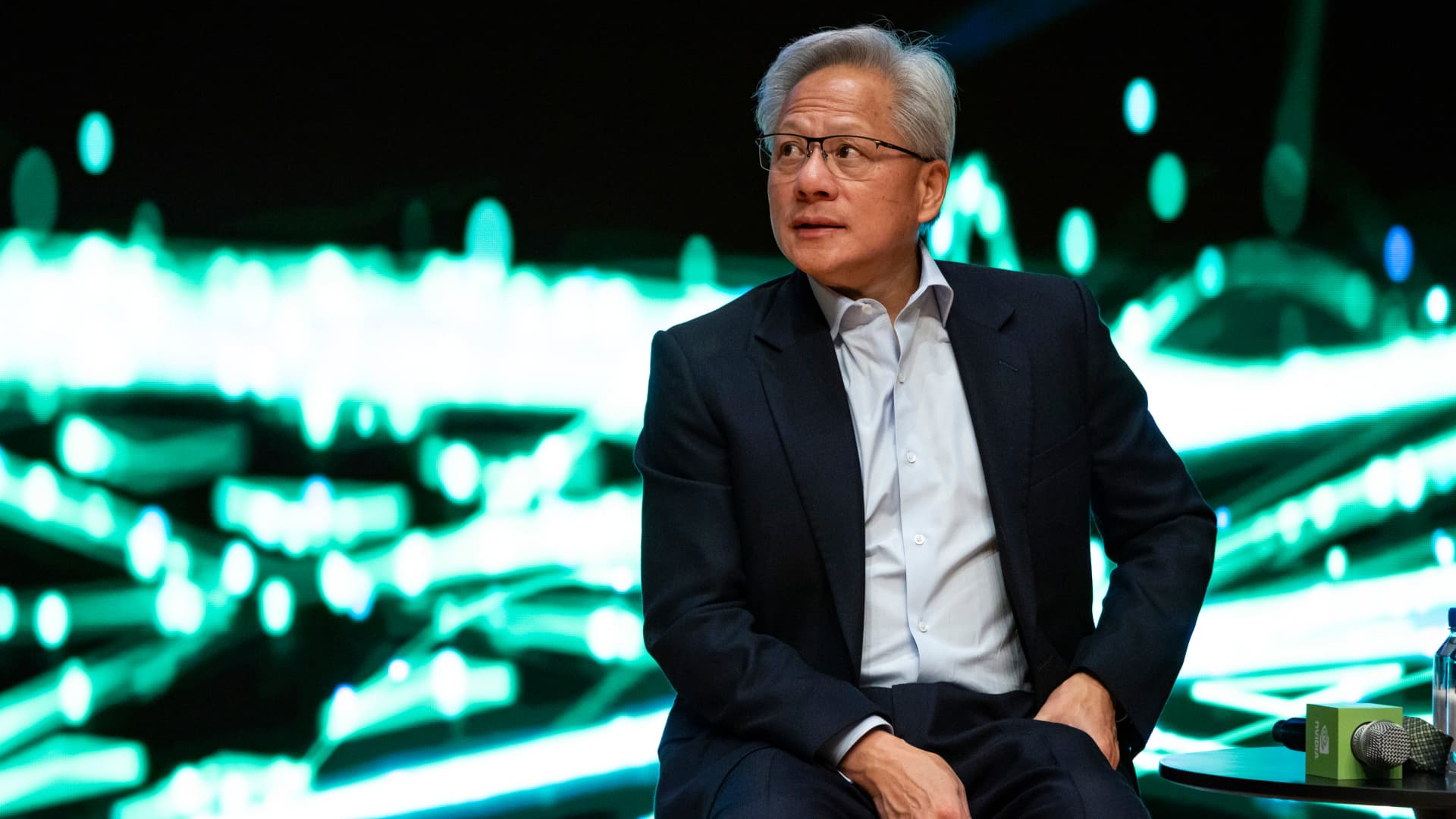

A few of the upward momentum got here from chip shares, which popped after Bloomberg reported that the Biden administration was contemplating further limitations on the sale of semiconductor gear to China that weren’t as sturdy as beforehand anticipated. Utilized Supplies and Lam Analysis rallied greater than 3% and 4%, respectively, whereas Nvidia jumped greater than 2%. The iShares Semiconductor ETF (SOXX) added practically 2%.

These strikes come as merchants look to the top of a profitable week and month. November buying and selling largely centered on the postelection rally seen on the again of President-elect Donald Trump’s victory.

The Dow has added greater than 1% week so far, bringing its acquire for November above 7.5%. The S&P 500 and Nasdaq Composite have every superior 1% on the week, and at the moment are monitoring to finish 2024’s penultimate month larger by greater than 5% and 6%, respectively. With these positive aspects, the Dow and S&P 500 are each on tempo to notch their finest months of 2024.

Dow, YTD

The small-cap-focused Russell 2000 outperformed in November as buyers noticed the group benefiting from Trump’s potential tax cuts. The Russell 2000 has surged about 11% this month, helped by a acquire of about 1.4% this week.

“The prevailing takeaway from November, to me, is that what was true earlier than the election has remained true after the election,” stated Ross Mayfield, funding strategist at Baird Non-public Wealth Administration. “As we head into December, it is actually onerous to fade this bull market right here, with all of the issues going proper, the election within the rearview and a seasonal tailwind that also has some room to run.”

Shares have additionally been lifted late this yr by expectations that rates of interest stay on a downward course, which raises the current worth of future earnings and may increase the economic system. Fed funds futures at the moment are pricing in round a 66% chance that the central financial institution will decrease charges by 25 foundation factors at its coverage assembly subsequent month, in accordance with CMEGroup’s FedWatch software.

The inventory market was darkish Thursday and closes at 1 p.m. ET on Friday in observance of the Thanksgiving vacation. There aren’t any financial information releases or company earnings reviews of observe on the docket for Friday. Buying and selling was mild.