The protection sector consists of corporations that present army items and companies, which embrace aerospace and protection manufacturing, cybersecurity, and superior applied sciences. This sector is fashionable for its stability as a result of it’s typically backed by authorities protection spending. This tends to stay constant no matter financial circumstances. Shares on this sector, equivalent to these of corporations producing army plane, autos, weaponry, and surveillance know-how, can fall underneath the class of much less delicate to financial cycles.

Defensive shares, whereas generally inclusive of utilities and client staples, additionally characteristic protection sector corporations as a result of their regular demand regardless of financial downturns. Investing in defensive shares can present buyers with a buffer towards market volatility, as these corporations typically provide constant dividends and sturdy efficiency throughout financial downturns. Nonetheless, the expansion potential of defensive shares might have limitations compared to cyclical shares. which might rise considerably throughout financial upturns.

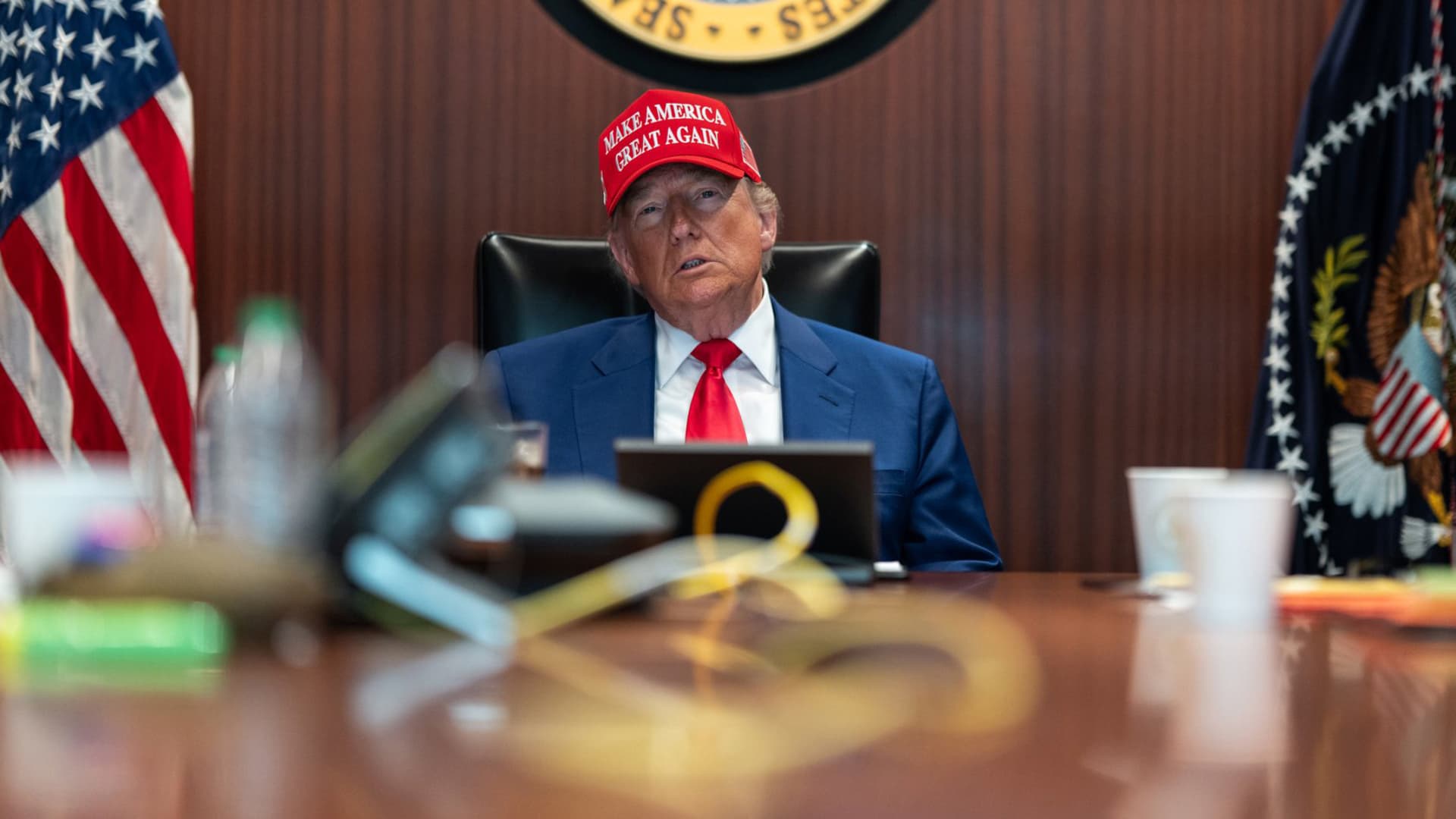

One drawback of investing in protection shares particularly contains their dependency on authorities budgets and insurance policies, which might shift with adjustments in political management. Moreover, these corporations might be concerned in controversies or moral dilemmas associated to world army operations and protection contracts. This may probably have an effect on public notion and inventory worth. Regardless of these dangers, the defensive nature of those shares typically makes them enticing throughout unsure market circumstances, offering a measure of security for funding portfolios. Protecting this on high of thoughts, listed here are two protection shares to observe within the inventory market right now.

Protection Shares To Watch Right this moment

- RTX Company (NYSE: RTX)

- Lockheed Martin (NYSE: LMT)

RTX Corp. (RTX Inventory)

First, RTX Company (RTX) is an aerospace and protection firm that operates worldwide. It supplies superior programs and companies for industrial, army, and authorities prospects. Its key merchandise embrace plane engines, avionics, aerostructures, cybersecurity, missiles, air protection programs, and drones.

Earlier this month, RTX Corp introduced that its Raytheon enterprise unit has secured a Navy ManTech mission. It was awarded by Penn State College Utilized Analysis Laboratory’s Electronics Manufacturing Middle of Excellence. The objective is to assist improve the manufacturing means of SPY-6 Transmit/Obtain (TR) modules. The initiative focuses on integrating manufacturing developments equivalent to automation, sourcing of recent supplies, and enhancements in course of yields. That is anticipated to cut back the price of manufacturing for the U.S. Navy over the SPY-6 radar’s lifecycle.

In 2024 up to now, shares of RTX Corp have elevated by 38.64% YTD. In the meantime, throughout Monday’s premarket buying and selling session, RTX inventory is buying and selling flat, trying to open at round $118.08 a share.

[Read More] 2 Month-to-month Dividend Shares To Watch In September 2024

Lockheed Martin (LMT Inventory)

Subsequent up, Lockheed Martin (LMT) is a world aerospace, protection, safety, and superior applied sciences firm with worldwide pursuits. It’s fashionable for its manufacturing of army aircrafts. Nonetheless, its operations lengthen into varied fields together with missile and fireplace management, rotary and mission programs, house programs, and power options. Lockheed Martin is a significant contractor for the U.S. Division of Protection.

Simply this month, Lockheed Martin introduced it has been awarded a contract by NASA to create the next-generation GeoXO Lightning Mapper (LMX) for NOAA. The contract has a worth of about $297 million. Intimately, the contract covers the event of two devices, with choices for 2 extra. That is an effort to enhance extreme climate monitoring capabilities. The LMX will provide superior detection and measurement of lightning, aiding forecasters in storm evaluation and prediction whereas enhancing security measures for tornadoes, hurricanes, and different extreme climate circumstances.

12 months-to-date, shares of LMT inventory have superior by 25.39% up to now. Furthermore, throughout Monday’s premarket buying and selling session, Lockheed Martin inventory appears set to open at round $571.92 a share.

If you happen to loved this text and also you’re enthusiastic about studying the right way to commerce so you possibly can have the perfect probability to revenue persistently then you’ll want to checkout this YouTube channel.

CLICK HERE RIGHT NOW!!