U.Ozel.Photos/E+ by way of Getty Photos

Though different firms are poised to have GLP-1 receptor agonist medication for weight reduction accredited, they don’t seem to be more likely to make a lot of a dent within the dominance of Eli Lilly (NYSE:LLY) and Novo Nordisk (NVO) who management the market now.

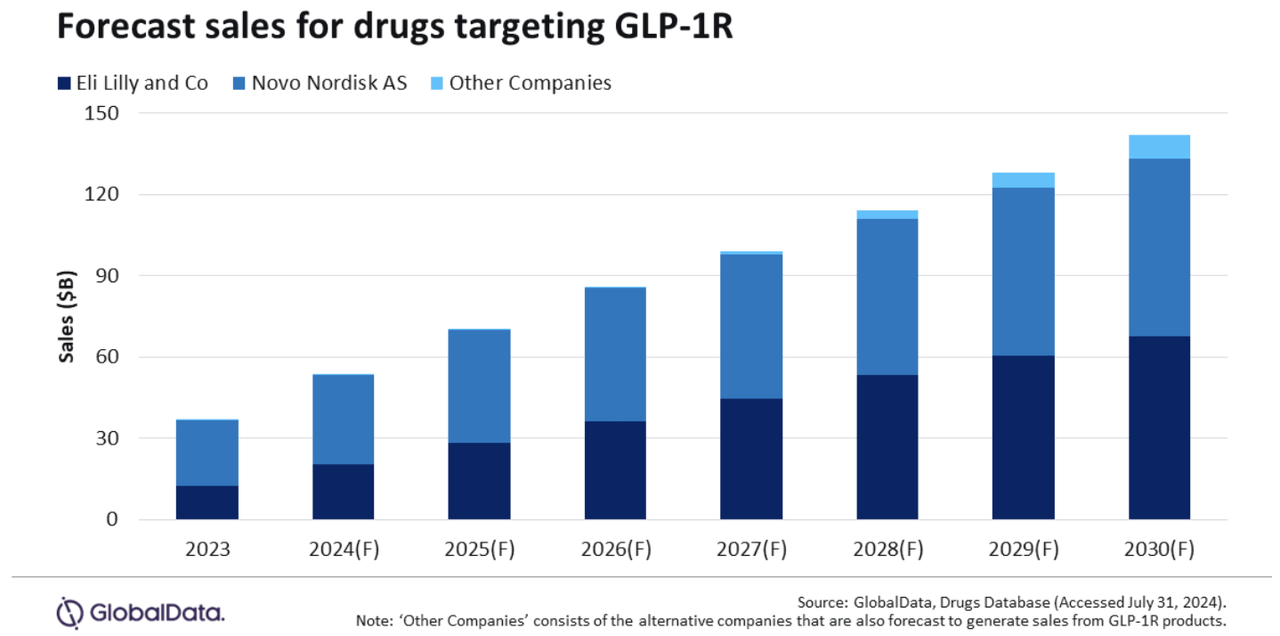

In 2023, the 2 firms accounted for 99% of all GLP-1R agonist gross sales. By 2030, that determine is simply projected to say no to 94% regardless of the possible entry of comparable drugs, based on GlobalData.

The class introduced in $37.2B in gross sales in 2023, the info and analytics firm famous.

Novo markets Ozempic and Wegovy (each semaglutide) for, respectively, kind 2 diabetes and weight reduction, whereas Lilly’s predominant GLP-1Rs are Mounjaro and Zepbound (each tirzepatide) for, respectively, diabetes and weight reduction.

By 2030, GlobalData initiatives that 14 different firms will probably be advertising and marketing GLP-1Rs. Nonetheless, these firms are anticipated to herald solely $8.8B in income, a determine “15 instances lower than the mixed valuation of the 2 main firms,” says GlobalData Pharma Analyst Jasper Morley.

GlobalData’s evaluation mirrors that given in June by J.P. Morgan’s Holly Morris and Cantor Fitzgerald’s Louise Chen who spoke on the Searching for Alpha Funding Summit on the load loss medication market. Morris mentioned that each firms’ measurement and attending to market first have possible cemented their management of the area, whereas Chen famous that differentiation will probably be key for any new entrants available in the market.

Lilly (LLY) and Novo (NVO) even have their very own superior GLP-1R medication within the pipeline. For the previous, it has the oral capsule orforglipron and the GIP/GLP-1/glucagon receptor agonist retatrutide in section 3, in addition to three different weight problems medication in section 2. Novo has CagriSema, a mix of semaglutide and the amylin analogue cagrilintide in addition to an oral model of semaglutide to be taken every day. The Danish firm additionally has three different weight reduction medication in section 2.

Probably the most eagerly anticipated new weight problems medication to doubtlessly come to market that’s not from Lilly or Novo is Amgen’s (AMGN) MariTide, which is each a GLP-1R agonist and a GIPR agonist. It’s at the moment in section 2 for diabetes and weight reduction.

Nonetheless, that candidate is predicted to generate solely $3B in gross sales in 2030, based on GlobalData.

Different candidates to look out for embody Viking Therapeutics’ (VKTX) section 2 VK2735, which Searching for Alpha analyst Stephen Ayers just lately gave a bullish evaluation of. An oral model of the candidate is in section 1. Roche (OTCQX:RHHBY) has three candidates in section 1 growth: a GLP-1R agonist, a twin GLP-1 /GIP receptor agonist (similar mechanism of motion as Mounjaro and Zepbound), and an anti-latent myostatin.

As well as, Zealand Pharma (OTCPK:ZLDPF) and Boehringer Ingelheim are growing survodutide whereas Altimmune’s (ALT) pemvidutide.