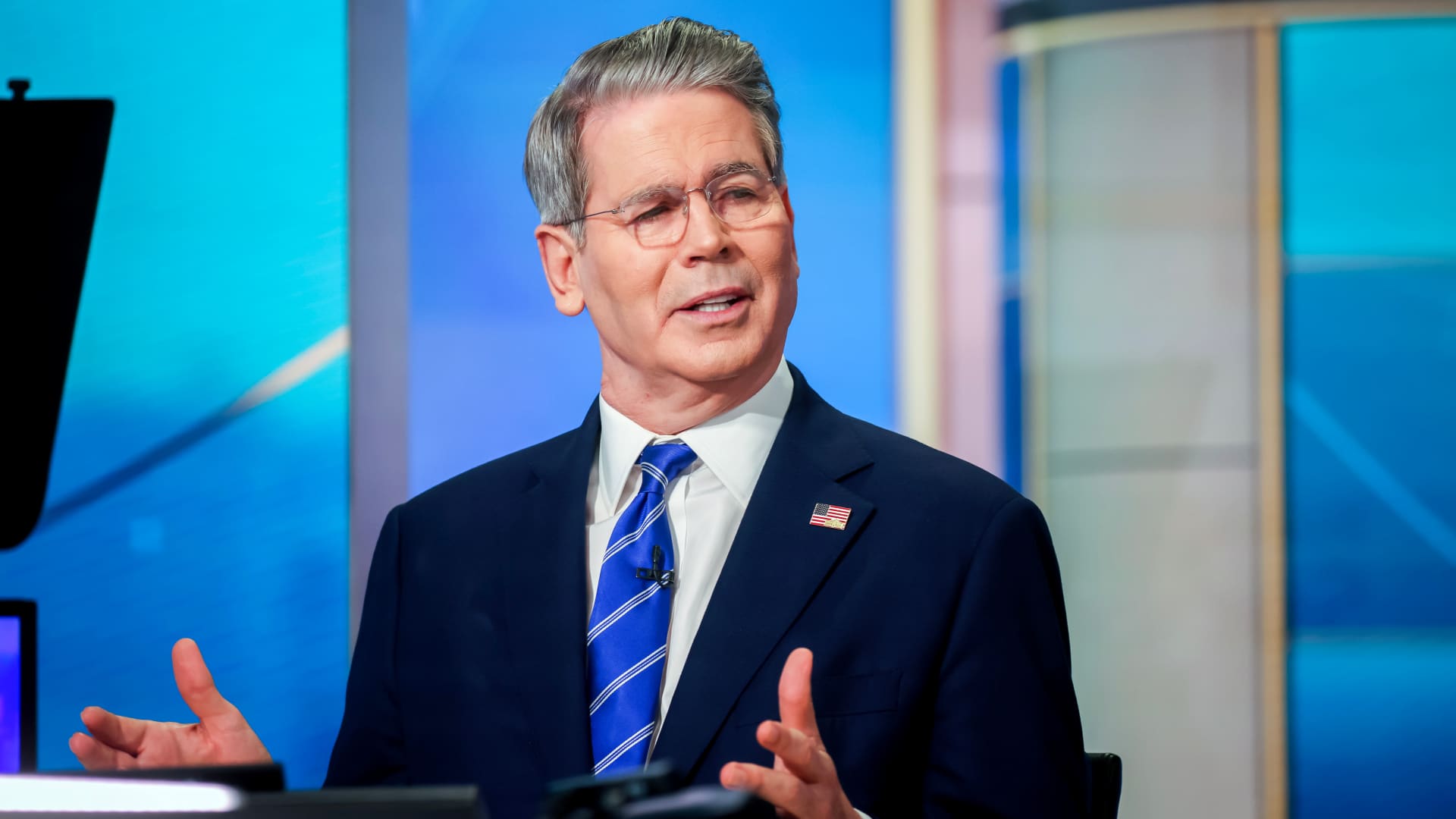

Treasury Secretary Scott Bessent stated Tuesday he’ll start interviewing candidates for Federal Reserve chair as quickly because the White Home whittles down what has abruptly grow to be a crowded discipline.

In a CNBC “Squawk Field” interview, Bessent confirmed the race to switch present Chair Jerome Powell is between 11 candidates, an array that features previous and current central financial institution officers in addition to economists, a White Home advisor and some Wall Avenue market consultants.

“By way of the interview course of, we have introduced 11 very sturdy candidates. I’ll be assembly with them in all probability proper after Labor Day, and to start out bringing down the checklist to current to President Trump,” he stated. “It is an unimaginable group.”

That checklist is believed to incorporate present Governors Michelle Bowman and Christopher Waller, Dallas Fed President Lorie Logan, White Home economist Kevin Hassett and former Governor Kevin Warsh. Strategists Rick Rieder of BlackRock and David Zervos of Jefferies are also a part of the group, in addition to economist Marc Sumerlin, former Governor Larry Lindsey and former St. Louis Fed President James Bullard.

Although Powell’s time period doesn’t finish till Could 2026, the White Home is eager to get the method shifting because it pushes an pressing want for rate of interest cuts.

Bessent repeated the administration’s need for alleviating, saying it might assist the moribund U.S. housing market. Gross sales and new constructing have been weak, with low stock pushing costs larger.

“If we preserve constraining residence constructing, then what sort of inflation does that create one or two years out?” he stated. “So a giant lower right here may facilitate a increase or a pickup in residence constructing, which can preserve costs down one two years down the highway.”

The Fed doesn’t have a coverage assembly once more till Sept. 16-17, the place it’s broadly anticipated to approve its first quarter proportion level discount since December 2024. Bessent stated he was not involved a couple of producer value index studying for July that confirmed the biggest month-to-month improve in three years, as he attributed a lot it to an increase in portfolio charges tied to larger inventory market values.

Earlier than then, Powell on Friday will give what is probably going his ultimate keynote tackle on the Fed’s annual symposium in Jackson Gap, Wyoming. That speech may give attention to a evaluation the central financial institution does each 5 years of its coverage, however Powell additionally might select to tip the Fed’s hand on the September vote.