Michael M. Santiago/Getty Pictures Information

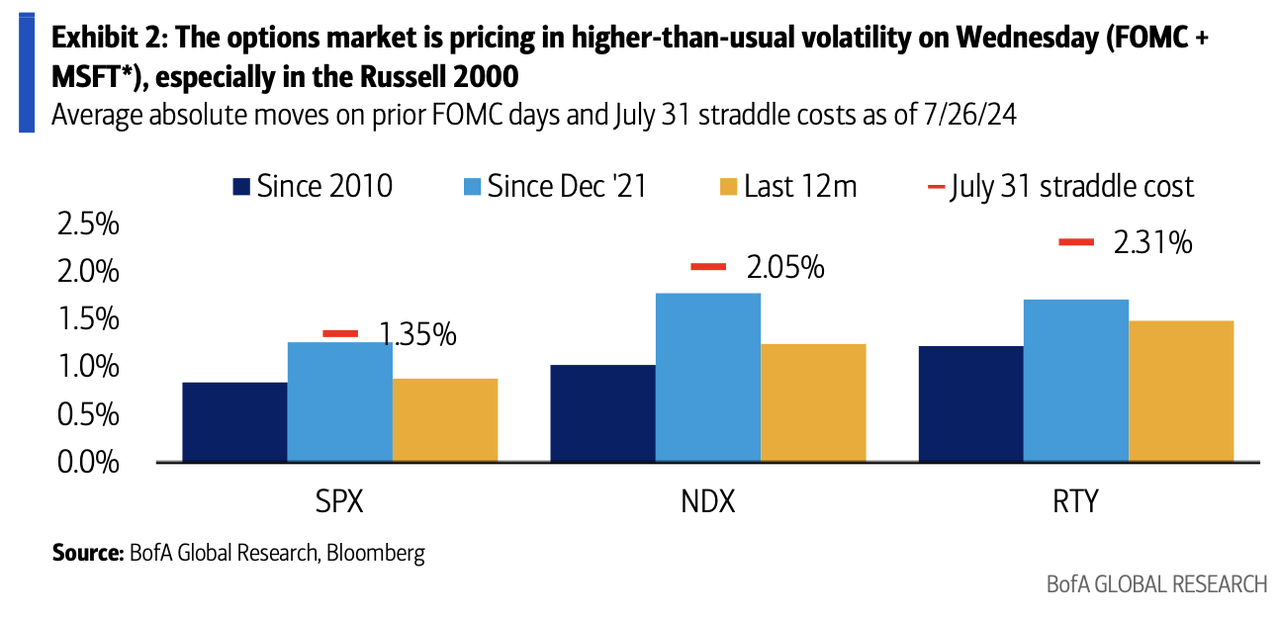

The choices market was pricing in higher-than-usual volatility for Wednesday’s session, based on Financial institution of America, which urged buyers shield positive aspects significantly in small-cap shares after their latest “historic” surge.

The choices market was pricing in higher-than-usual volatility, particularly within the Russell 2000 (RTY) index of small-cap shares, Financial institution of America stated in a word. Buyers on Wednesday afternoon will search for the Federal Reserve to sign the potential begin of its rate-easing cycle this yr. Forward of that, markets will have already got in hand quarterly outcomes from Microsoft (MSFT), one of many Magnificent 7 mega-cap tech shares.

“The implied RTY transfer for Wednesday is 2.31%, and regardless of a latest rise in Russell 2000 spot-vol correlation making outright places costly, put spreads stay a horny method for buyers to hedge a attainable RTY (RTY) pullback after its historic run,” Ohsung Kwon, fairness and quant strategist at BofA, stated within the word.

This month’s rotation into small-caps from large-cap tech shares has resulted in exceptional strikes by the Russell 2000 (RTY), together with marking its highest 5-day outperformance over the Russell 1000 index since 1979, BofA stated. The market shift jolted by revived rate-cut expectations has despatched the Russell 2000 (RTY) flying up ~9% in July.

A decrease Russell 2000 (RTY) shouldn’t be BofA’s base case, Kwon stated. However sturdy tech earnings and/or a hawkish Federal Open Market Committee “exhibiting hesitation” on chopping charges in September after final week’s stronger-than-expected Q2 GDP report may result in close to term-declines for small-caps, he stated. Tech-sector outcomes are additionally due this week from Meta (META), Apple (AAPL) and Amazon (AMZN).

BofA printed this chart of options-market pricing:

Listed here are a number of small-cap ETFs to trace: (IJR), (IWM), (VB), (DFAS) and (SCHA).